Make the complex simple. Make the simple compelling.

Make the complex simple. Make the simple compelling.

Business consulting often gets overcomplicated.

And complexity doesn’t help business owners – it slows them down.

Our job?

Make the complex simple. And the simple compelling.

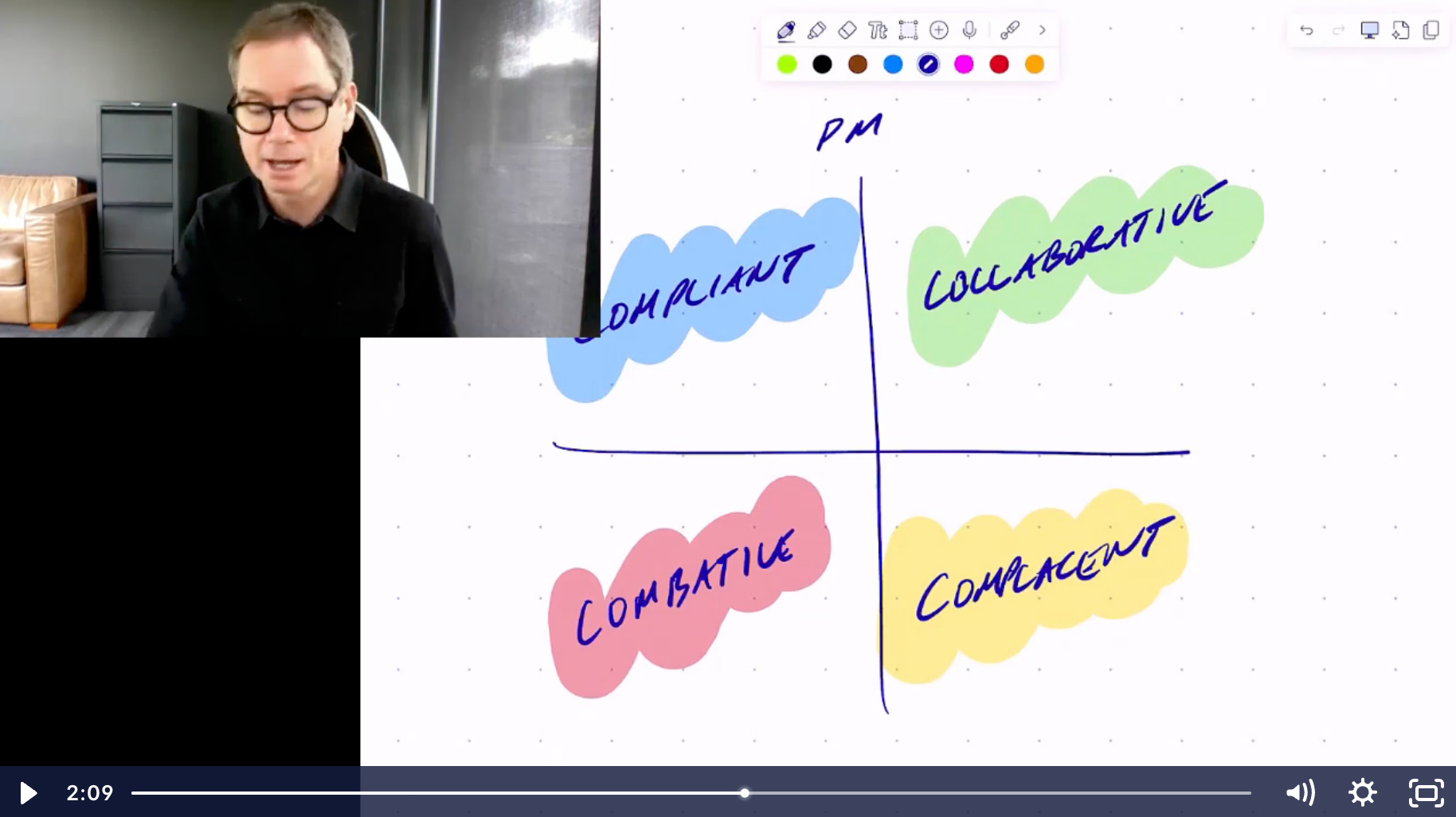

That’s why we use models. Visual tools that cut through the fog.

Take leadership and culture.

Most owners think their team’s the problem – slack, lazy, hard work to manage.

But the truth is, teams usually reflect the leadership.

And that’s confronting.

We see four types of teams:

1. Compliant – do what’s asked, nothing more.

2. Complacent – social club vibes.

3. Combative – not happy to be there, and everyone knows it.

4. Collaborative – the goal.

What makes the difference?

Two levers: performance measures and engagement.

No measures, no engagement – you get complacency or combat.

Clear measures without engagement – you get compliance.

Put both in place – you build collaboration.

That’s how culture changes.

That’s how leadership improves.

5 Red Flags that it might be time to think about what's next...

5 Red Flags that it might be time to think about what's next...

Every job has its highs and lows. But how do you tell the difference if a low is something deeper that means it’s time for a change?

So here are 5 red flags that I’ve seen and experienced that are signs that it might be time to think about leaving your current job and doing something new…

First one’s obvious…

- You’re married to the job

It feels like you spend every waking minute working, or thinking about work. It’s your number one excuse for everything… “I’ve got work” so you’re missing out on family and friends and life because you’re basically married to your job. When your job basically owns you, it’s time to think about what you’re missing out on… - You’re not challenged in your role

You’ve climbed the ladder and you’re well established and any crisis is the same crisis that you’ve managed to get through many times before so you know it’s not really a crisis and you look at others with less experience and understanding of how things work and know that you can run rings around the whole system. It’s just not a challenge any more. You’re bored… - You’ve stopped thinking big

When you started your career you knew you had high capability and could go all the way with your ideas and passion. But at some point you lost that ability to think big because of all the hurdles people put up who don’t have your vision. You figured out they’d rather block you than support you so you’ve stopped with the big ideas… - You dread going to work

You know your heart’s not in it and you’re basically doing it for the money which feels a bit shallow… but you justify it by saying things like “I’m doing it for my family” which means you’re being a martyr… and somehow that it makes it ok stay in a career that you resent and the reason you stay in it is because you’ve convinced yourself that you have no other options. So you dread going to work. - You’ve made it to number 5

You wouldn’t have listened to this if you weren’t looking for reasons why what you’re doing at the moment is not giving you what you want. Your business skills are valuable and there’s a whole other world of how to make money in a career that doesn’t mean what you’re doing at the moment is the only option…

So, if you feel like it’s time to think about options, check out an info pack on what being a business advisor to small businesses is all about… you might hate it, but at least you’ve made a start… and there’s always the possibility that you might love it too!

How do you guarantee great results for every client?

How do you guarantee great results for every client?

Simple.

You don’t show up empty-handed.

At Trusted Advisor Network, we’ve built a complete library of tools, training, templates and ready-to-use presentations – so our advisors walk in with the gear to deliver real wins, right from day one.

Think of it like a business performance system that covers everything:

1. Profit margins and cashflow

2. Hiring, leading and keeping great people

3. Sales systems and follow-up

4. Marketing strategies that actually convert

5. Quarterly planning and tracking results

Every session comes with a proven workbook.

Every workbook comes with a structured path to action.

You don’t have to start from scratch and your clients don’t either.

It’s the difference between “knowing your stuff” and being able to prove it in front of a client.

That’s what gives our advisors the confidence to grow fast and get results that stick.

So if you’ve ever thought about taking your business background and turning it into something bigger – this is how you make it real.

Take a look and ask yourself: what could you do with this in your hands?

What Happens When You Leave Corporate?

What Happens When You Leave Corporate?

What Happens When You Leave Corporate?

Especially after you’ve been with a place for a long time… what’s different, what’s noticeable?

Let me tell you what I noticed in myself that I’ve seen in other who have left corporate to become a self-employed business advisor…

First thing is FORMALITY… the way you communicate changes. When people quit the office, they realise there’s no need for being so measured and “on point” the whole time.

That’s a realisation that I hear a lot is that people realise how uptight they’d been and how much more relaxed their communication style can be when they’re not trying to match the behaviour that their role or their company seem to expect.

It’s like there’s a lot less processing and filtering of what they say… so that’s the 1st thing I’ve noticed. Formality, not really any need for it any more.

Second thing is people talk about the FLEXIBILITY of being in control of your own time.

And the way they talk about it is with a sense of awe and wonder and disbelief.

They’re like, “I dropped the kids at school and then I went to the hardware store to get something for the house and I didn’t even feel guilty”.

They simply can’t believe that these simple day-to-day things were completely unavailable to them for so long…

They are literally amazed at how entrenched they let themselves get to in their corporate life while this whole other life existed outside the bubble that they’d put themselves in!

Third thing I’ve noticed is CONFIDENCE… it’s like they rediscover who they are as a person.

I think what it is comes from once the status of their role falls away, they see themselves as a person again that can completely be themselves.

It doesn’t happen straight away, but we have conferences every 6 months and I literally see a happier, more energetic and brighter person when they discover that they can reinvent themselves as the person they were before their personas got machined into the corporate warriors that they’d turned themselves into.

I’ve heard it said a few times people calling it “shedding their corporate skin”.

So, my question to you is, what would shedding your corporate skin be like for you?

Who would you be without the pressure and the status of your role?

What would you be able to do more of and who would you spend more time with if you didn’t have the demands of being in an office all week.

Would you be more energetic, more relaxed, more present?

Have a think about the corporate you and the you that you’d be without the expectation of your role.

If you could earn the same or more outside of the bubble, which version of yourself would you be happier with.

Not always an obvious answer, but definitely one to think about…

What makes TAN Different?

What makes TAN Different?

So, I got asked this week what’s the difference between TAN and anyone else… what’s your point of difference.

Fair question! When it comes to a POD, I think there’s a philosophical POD which is basically what drives me to run TAN as a business owner… maybe that’s interesting to you…

But I think operational PODs are probably more practical/tactical that you’d find more useful. So, let’s talk about how we do marketing vs everyone else.

Our target market is local business owners, not specific niches or from all over the country or globally. It’s just local business owners of between 3-30 staff that are all right under your nose.

I mean why build massive databases with endless lead magnets when in reality you only need 8-10 clients at $2K a month to have a $200K+ income.

And you drive past hundreds of local businesses every day so why would you need complicated online funnels and endless tech to find leads… they’re right in front of you!

I mean local might be seen as boring, so maybe boring is our point of difference?! Here’s another marketing reality… have you noticed that AI has completely clogged online ads and content with such a volume of noise that it’s hard to hear anything at all?

Given that we’re targeting local, why would we join that online noise when we can run small workshops for local business owners to come to where they can experience our content helping them first hand.

When business owners experience our people and our programs, they don’t need ad campaigns to explain what we do, they just get it.

Experience beats explanation. So that’s another POD, we do in-person mini-workshops rather than trying to compete with all the AI driven on-line noise.

Sounds old-school, it is!

Apart from the marketing angles, our client onboarding process is different too.

I talked to one of our newer members on the phone just yesterday.

He said, “Will you need to hear this… my last 2 clients both said our signup process gave them so much value BEFORE we even asked for any money that they were HAPPY to pay us… they literally said, thank you when he showed them the program that we were going to work on with them”.

He told me he’s never experienced a sales process like it. We give a tonne of value to business owners… and it works because it’s not a super-slick sales tactic, it’s because we’re providing genuinely helpful business insights.

Our sales and marketing process is working better now than ever and AI has helped that. Because the business owners we’re marketing to can smell cookie-cutter content a mile off… and they avoid it.

So, what’s our point of difference… well it seems to me while other outfits are marketing themselves as Ferrari’s, we’re more Mark 2 Cortina… you’re never going to see me in a video driving some fancy car talking about how rich I am and how you can be just like me if you buy my stuff… T

AN is the Cortina of advisory.

That’s our point of difference. Low glam, low tech, locally based, high service, solid results. Boring.

And if you’re wondering what my philosophical POD is, my role in life is to professionalise business advisory because business owners need real help from real people with actual business backgrounds that produce bankable results.

No fluff, no Ferraris, just a trusted advisor to help them run their businesses professionally. It’s a lifelong goal and I’m just getting stated.

What happens when you're decades into your corporate role, but it's lost its shine?

What happens when you're decades into your corporate role, but it's lost its shine?

What happens when you’re decades into your corporate role, but it’s lost its shine

• You’ve given it 100% of your energy for years

• You know they’d drop the ball without you

• You know it’s not being run with the same ethics

BUT The job’s been your identity for so long and maybe you can’t imagine doing anything new

SO Have a think about what you loved about your job…

• Travelling around and meeting with new people

• Building a team and working on ambitious projects

• Seeing the results of decisions you’ve made

• Being acknowledged for success

BUT What couldn’t you do with your job…

• Spending time with family

• Watching kids play sports

• Being able to take time off, and…

• Always thinking about work even when you’re home

SO What would your ideal situation be…

• Flexibility so you didn’t have to be at the office all the time

• Using the business skills you have to make a difference to peoples’ lives

• Being in charge of the way you run things with the kind of ethics you believe in

POSSIBLE?

• We’ve got a couple in our network who love what they do and make a very big income that they’re able to run from their boat! Or…

• Another one wanted to make enough income so his wife didn’t have to work… that’s a box that’s also been ticked.

If you’re wondering what’s possible, you owe it to yourself to at least explore other possibilities outside of what you’re doing right now…

do a bit of due diligence and see what else is out there.

Being your own boss is awesome… see what it’s all about!

You’ve Got the Skills. Here’s How to Price Them So You Actually Get Paid What You’re Worth.

You’ve Got the Skills. Here’s How to Price Them So You Actually Get Paid What You’re Worth.

It’s Will here from Trusted Advisor Network, and I wanna talk about something that a lot of smart, experienced business people run into the moment they try to turn what they know into something they can sell.

You’ve probably got a strong background—maybe you’ve managed teams, run businesses, built stuff from the ground up, or helped companies through big changes. And now you’re looking at business advisory and thinking:

“I know this could help other business owners—so how do I package it up in a way that actually makes sense… and makes money?”

That’s where pricing comes in. And to be honest, it’s one of those things that sounds a bit boring on the surface—but once you get it right, it completely changes the game.

So let’s talk through it.

There are four main pricing models I see all the time in the business advisory space. Let’s break ‘em down.

1. Hourly or Day Rate

This one’s the default.

You set a rate—maybe $200, $300 an hour. Maybe $1K to $2K a day. You go in, you do the work, you get paid.

It’s simple, and it’s easy for clients to understand. But here’s the problem:

When the job’s done, the money stops.

You’ve gotta be in the room, doing the thing, to get paid.

Which means no leverage, no compounding, and no time to breathe.

It’s a short-term fix that doesn’t build a long-term business.

2. Project-Based Pricing

The next one is charging per project.

You sit down with the client, scope out what they need, set a fixed fee, and deliver the result.

It’s tidy. Everyone knows what they’re getting. But it comes with the same issue as hourly work:

Once the project’s done, you’re back to square one.

You get stuck in the cycle of doing the work → chasing the next gig → doing the work again.

It’s busy. It’s draining. And it doesn’t leave much room to grow.

3. Courses and One-Off Programs

This one’s a favourite for people who want more leverage.

You take what you know, you turn it into a course, and you sell it as a product.

Clients like it because it’s structured. They can see exactly what they’re getting.

But here’s the catch:

It still ends.

Whether it’s a 6-week course or a self-paced program, at some point, the delivery wraps up—and you’re back to finding the next batch of clients.

So again, you’re not building continuity. You’re just resetting the clock.

4. Retainers and Continuity Programs

Now this is where things start to click.

Instead of short-term projects or one-off courses, you build a long-term relationship.

You set up a program where the client pays a fixed amount every month—not for a single deliverable, but for ongoing support, accountability, and real results over time.

Here’s why that matters:

-

You’re not starting from scratch each month

-

You can plan your income

-

And your clients get better outcomes because you’re there to help them implement, adapt, and stay on track

This is where you move from being a consultant-for-hire to being their go-to partner.

And the numbers stack up fast.

If you’ve got four clients on retainers worth $25K a year, that’s a $100K advisory business.

Double it? $200K.

And you’re still working with a small, manageable group of clients that you actually like.

So What’s the Best Fit?

Depends on what you want to build.

If you’re after flexibility, leverage, long-term relationships and real impact—retainers are the way to go.

But whichever model you use, just make sure you’re not underselling your experience.

You’ve got decades of know-how. You’ve done the hard yards. Price it in a way that reflects the value—not just the time.

So you know how to fix and grow businesses… but do you have the skills to be a successful Business Advisor?

So you know how to fix and grow businesses… but do you have the skills to be a successful Business Advisor?

So you know how to fix and grow businesses… great! But what are the skills you need to acquire that will give you the base you need to be successful as a business advisor. You’ll probably have an idea of what “coaching” skills are. But technically, what does a professional business coach know how to do, that maybe you don’t?

There are four areas where a professional business coach will have strong skills that are worth having a look at… especially if business advisory is a track you’re thinking about.

Firstly, a professional business coach has a set of beliefs that are different to most people. I call it being an “unreasonable friend”. Maybe you’ve got a friend who always seems to have an unreasonable expectation that you’re capable of more, no matter what! They believe in you for sure, but they expect you to be smashing it and they don’t listen to any lame excuse from you if you try and push back on them. That’s what the best business coaches are like… an “unreasonable friend” where their permanent belief is “nice, need more!”

Secondly, a professional business coach knows how to make the complex, simple and the simple, compelling. And the way they do that is by drawing simple models and using simple formulas. Check out my latest video for an example that uses a simple triangle… every industry is made up of many businesses. They’re all in the same industry with the same opportunities, but depending on how the businesses are run, you’ll see very different results. So, the top 20% of businesses end up making 80% of the money, while the bottom 80% scrap around for only 20% of the money. This is true for local plumbers, in the same way it’s true for companies like Apple. The question is, what do these guys know, that these guys don’t… and how do you get above the line if you’re stuck down here. PAUSE, can you see if you’re a local plumber, you probably want to know the answer… it’s compelling! And all I needed was a triangle and a line to make the complex, simple and the simple compelling. Coaches are great at using models!

Thirdly, professional business coaches are awesome at profiling tools. When you know how to use tools like DISC and Values profiles, it means you’ll know systematically how to motivate and challenge your clients based on their profile. This means you’ve got an unfair advantage when it comes to getting high performance out of your clients. These tools are so powerful when you know how to use them that you can literally predict what your clients will be doing to sabotage their success. And when you point it out to them, they can’t hide and that’s where break-throughs happen. Profiling tools are very powerful in the hands of professional business coaches who know how to use them.

Last one, professional business coaches have perfected what I call “the art of the ask”. They know how to string questions together in a very specific sequence that causes people to become very focused and clear on the actions that they need to deliver for their coach. Most question-based sequences are based on a very old coaching process developed by John Witmore called the GROW model. G stands for “Goal” based questions such as “what’s the outcome you want but don’t have?”. The next letter in GROW is R which stands for “Reality” based questions such as “what’s the current situation that you’re not happy with?”. These first 2 parts of the GROW model are designed to get a gap. No coaching is possible without the person being coached acknowledging that they have a gap between what they want vs what they have. Now we can ask questions about Options, that’s what the “O” stands for in GROW. Questions such as “so what could be done to close the gap?”. Then the last type of coaching question is where the accountability comes in with “What will you do based on the options we’ve talked about?”. GROW gives you a simple framework for your questions and professional business coaches are masters at this. Questioning sequences is a core skill and often the hardest to learn especially if you’re used to being the person with all the answers!

That’s the advantage professional business coaches have over people who have great business backgrounds. Four skills… beliefs, models, profiles and questions… and they’re all learnable!

Your corporate background is both your biggest asset

Your corporate background is both your biggest asset and your biggest hurdle when it comes to working with small businesses…

Your corporate background is both your biggest asset and your biggest hurdle when it comes to working with small businesses… what do I mean?

It’s your greatest asset when you have clients—because you know how to spot problems and opportunities and fix them fast.

But just because you know how to help doesn’t mean a business owner will want your help—or pay for it.

So where’s the hurdle?

It shows up when you’re trying to get clients.

During acquisition, your background often works against you.

Let’s say you ask a business owner, “How’s business?” and they say: “It’s a bit tough—cash flow is tight, staff are hard to find, and I’m always busy.”

What’s your instinct?

Fix it! Cash flow. Staff. Time.

You immediately start thinking through solutions: pricing, debtors, SOPs, time management, delegation…

Because that’s what you’re good at, right?

And yes—it would all help if they were already a client.

But it doesn’t work when they’re a prospect.

Why not?

Because business owners defend their position.

You might be right, but they can’t just say, “Oh wow, great point—I feel silly for not thinking of that.”

They’ll think:

“How would you know?”

“I already tried that!”

“Don’t you think I’ve thought of that before?”

They don’t want to be fixed—even if they need it.

That’s the hurdle: you’re wired to solve problems, but people don’t buy advice just because it’s right.

So what gets them to buy?

When they ask you for help.

When they own the problem.

That’s the key shift—from fix-it to coach.

Coaching is about helping people see what they need help with—not telling them.

And that’s what I want to show you—how a simple model can change the dynamic completely.

Let’s say you take a coaching approach instead.

You assume every business owner has some combination of a time, team, or money problem—because 90% of the time, that’s true.

Now listen carefully and draw what they’re saying.

“So… you’re here in the middle… you’ve got staff issues, so you’re trying to get more out of the team… things are tight, so you’re trying to generate more cash… and you’re super busy, trying to manage it all.”

No judgment. No fixing. Just reflecting.

Then ask:

“That sounds tough… of these three—team, time, or money—which is the biggest challenge for you right now? How long’s it been like that? What’s it costing you—in time, money, headspace?”

Let them talk.

Then you say:

“Some business owners seem to make it look easy. They run what we call the Ideal Business Cycle… The owner looks after the team, the team look after the customers, customers look after the business, and the business looks after the owner. Sound better?”

If they say: “Yes—but how?”

Boom. They asked.

That’s the shift.

That’s how you move from being right to being invited.

And that’s how clients come onboard—by choice.

Number 1 Reason For Leaving Corporate Right Now

Number 1 Reason For Leaving Corporate Right Now

I speak to many people in corporate positions who are really well paid. They’ve got MBAs and well qualified, and they’ve got a ton of status in their roles. And my question is, like, why are you looking to leave? And the number one thing that comes up is culture.

Things have changed in the company. They don’t believe that the changes are for the good, and it’s just a clash. And they decide that they just can’t do it anymore. I’ve just come back from a four day training in Brisbane where we trained eight new business consultants to enter the local business market.

And in the training room, we had CEOs, ex MDs.

We had people who were serial entrepreneurs that had multiple businesses.

And a big reason for changes kept on coming up time and time again was this whole thing about culture. I want to share a couple of these stories and see if they resonate with what’s happening in your world at the moment. Like there was an ex CEO, and he was working for a large family business and the family business got sold and straight away, big culture changes. And he got to a point where he’s just like, I can’t do this anymore.

Well, how about this? This is a really amazing story. Ex managing director, he had negotiated with staff, quite a big staff, six hundred k worth of bonuses because there were all these strikes happening, and the business interruption was costing the corporation an absolute fortune. So they negotiated these great bonuses.

Everyone was happy. Productivity went through the roof. All the strikes, no longer. Everyone was getting on great, except when new leadership came in, and they saw six hundred ks in the p and l.

And in the cost cutting measure, they said, well, what’s that for? Well, that’s gone. We don’t need that. Now in a heartbeat, all the industrial action came back.

All the productivity went down the sink, and all the goodwill that had been built up over years of negotiating, completely evaporated in in one cost cutting move. Another example, there was a senior exec there, in the training room, and he told me about a situation where they had a really strong point of difference against them and the competitors. Same thing again. New new restructure came through, and and suddenly that point of difference with their with their customer base, just the focus went completely away from all of that.

And what it meant is that whole point of difference, gone. So guess what? they’re competing on now because they don’t have that point of difference. It’s just a race to the bottom on price. So these are culture changes that really affects people.

And I think when people ask themselves the tough questions of, am I happy doing what I’m doing? Am I still excited about it? Do I feel like I’m making a difference?

And ultimately, does what I do actually matter? These are the sorts of things that a culture will either have people behaving into or behaving out of. So my question to you is, what are the sorts of culture changes that you’re seeing, for better, for worse?

How are incentives being managed in your business in terms of for performance? How is that working in your workplace? Has it changed? Does it still work for you?

Do people still feel motivated about that? Or what about the whole team engagement side of things? Is there a high care factor? Or is it just some sort of HR tick box thing that you have to sort of jump through?

And same thing about values. Have you seen values changing? You know for yourself, you live with a set of values and you do your best to align those values with the people that you’re working with. How’s that changed?

If it has, let me know. I’d love to hear from you. So that’s my thoughts around culture. I think it’s one of those magical things.

It’s quite hard to articulate. When you’ve got it, everyone feels great, but it can change just in a heartbeat. Change a leader. Change a culture.

Let me know what’s happening in your workplace. Love to hear from you!